Understanding Forex Trading: A Comprehensive Example

Forex trading, or foreign exchange trading, is the process of buying and selling currencies on the foreign exchange market with the aim of making a profit. It is the largest financial market in the world with trillions of dollars traded daily. To delve into this dynamic field, let’s consider a concrete example that illustrates its inner workings and best practices. For those looking to get involved, you might consider starting with forex trading example Trading Broker UZ, which provides resources for novice traders to enter the market.

Basic Concepts of Forex Trading

The foreign exchange market operates 24 hours a day, five days a week, and is influenced by numerous factors, including economic indicators, geopolitical events, and market sentiment. To understand Forex trading, you need to familiarize yourself with some fundamental concepts:

- Currency Pairs: Trades are conducted in currency pairs, with each pair consisting of a base currency and a quote currency. For example, in the pair USD/EUR, USD is the base currency and EUR is the quote currency.

- Pips: A pip (percentage in point) is the smallest price move that a given exchange rate can make. Most currency pairs are priced to four decimal places, meaning a movement from 1.1000 to 1.1001 constitutes a one pip increase.

- Leverage: This allows traders to control larger positions with a smaller amount of capital. While it can amplify profits, it also increases risk significantly.

Example Scenario: Trading EUR/USD

Let’s consider a specific trading scenario using the EUR/USD currency pair — the most traded pair in Forex. Assume that the current exchange rate is 1.2000, which indicates that buying one Euro costs 1.20 US Dollars.

Step 1: Market Analysis

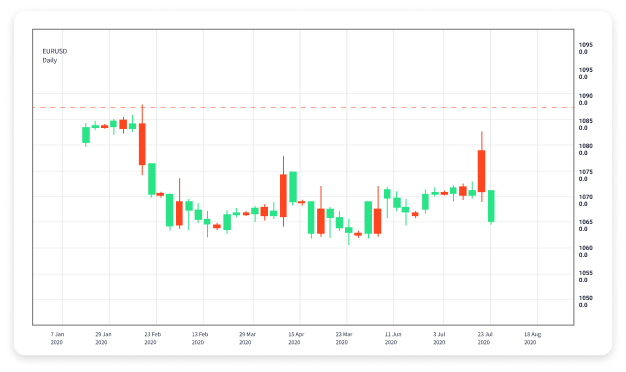

Before making a trade, analysis is crucial. Traders often rely on technical analysis (using charts and indicators) and fundamental analysis (considering economic news and data).

In this example, you anticipate that the Euro will strengthen against the Dollar due to favorable economic indicators from the Eurozone, such as an increase in GDP and a decrease in unemployment rates.

Step 2: Opening a Position

You decide to buy 1,000 Euros at the price of 1.2000. This means you will spend 1,200 US Dollars on this trade. If all goes well, and the price rises to 1.2500, you would then sell your Euros back at the higher exchange rate.

Step 3: Closing the Position

When the market price reaches your target of 1.2500, you close your position. At this price, your Euros can be exchanged for 1,250 US Dollars. Thus, the profit from this trade would be:

Profit = Selling Price – Buying Price = 1,250 USD – 1,200 USD = 50 USD

Strategies for Successful Forex Trading

To maximize your potential for success in Forex trading, consider the following strategies:

- Risk Management: Always use stop-loss orders to limit potential losses. This helps protect your trading capital.

- Stay Informed: Keep up with the latest market news and economic reports that may impact prices.

- Practice with a Demo Account: Before risking real money, practice your trading strategies on a demo account to develop your skills.

- Diversify: Do not put all your trades on one currency pair; diversify your portfolio to spread risk.

Emotional Control in Forex Trading

One often overlooked aspect of trading is emotional control. Many traders make impulsive decisions based on fear or greed. The key is to remain disciplined and stick to your trading plan, regardless of market movements.

In our example, if price drops to 1.1900 shortly after your purchase, resist the urge to panic sell. Instead, reevaluate your analysis and consider if your initial thesis may still hold.

The Role of Trading Platforms and Brokers

Selecting a reliable broker is vital to successful Forex trading. Look for brokers that offer user-friendly trading platforms, competitive spreads, educational resources, and excellent customer service. Here, Trading Broker UZ may serve as a good starting point for beginner traders.

Conclusion

Forex trading can be both exciting and profitable when approached with the right knowledge and strategies. By understanding market dynamics, analyzing currency pairs, and maintaining discipline, you can enhance your trading outcomes. Whether you are just starting or looking to refine your trading skills, always keep learning and adapting to the evolving market landscape.