The Rise of Mobile Forex Trading: Opportunities and Challenges

In recent years, the financial landscape has transformed dramatically, particularly with the rise of mobile technology. Traders who once relied solely on desktop platforms are now transitioning to mobile forex trading for its convenience and flexibility. This article explores the advantages and challenges of mobile forex trading, and how platforms like mobile forex trading trading-uganda.com are revolutionizing the way we engage in currency trading.

The Emergence of Mobile Forex Trading

The financial markets are always on the move, operating 24 hours a day, five days a week. Mobile forex trading apps have emerged as critical tools for individuals who want to stay connected to the market, regardless of their physical location. The ability to trade on-the-go allows traders to capitalize on market movements in real-time, enhancing their potential for profit.

Advantages of Mobile Forex Trading

1. Accessibility and Convenience

One of the primary advantages of mobile forex trading is its accessibility. Traders can log into their trading accounts from anywhere, using their smartphones or tablets. This convenience means that traders can react quickly to market fluctuations, execute trades in real-time, and monitor their investments without being tied to a desktop computer.

2. Advanced Trading Tools

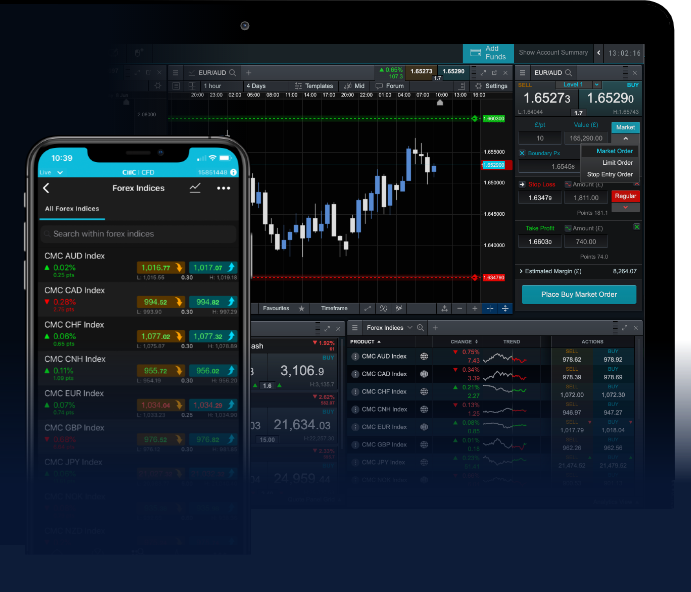

Modern mobile trading applications come equipped with advanced trading tools and features that were once exclusive to desktop platforms. Traders can access comprehensive charts, real-time analytics, and various indicators to inform their trading strategies. Many apps also offer features such as one-click trading and customizable alerts, enabling users to optimize their trading experience.

3. User-Friendly Interfaces

Mobile trading platforms are designed to be user-friendly, catering to both novice and experienced traders. With intuitive designs, traders can quickly learn how to navigate the app, execute trades, and manage their accounts with minimal effort. This ease of use empowers more individuals to participate in forex trading, expanding the market significantly.

4. Cost-Efficiency

Mobile forex trading often incurs lower costs compared to traditional trading methods. Since many platforms have eliminated the need for physical presence and offices, they can offer lower commissions and transaction fees. Moreover, traders can save on travel expenses that would have been necessary to reach a trading venue.

Challenges of Mobile Forex Trading

1. Security Concerns

While the convenience of mobile trading is impressive, it also raises significant security concerns. With the increase of cyber threats and hacking incidents, traders must remain vigilant to protect their accounts. Using secure passwords, enabling two-factor authentication, and choosing reputable trading platforms are essential steps to safeguard investments.

2. Screen Size Limitations

Despite advancements in mobile technology, the limitations of screen size can pose challenges for traders. While desktop platforms provide extensive views of charts, reports, and data, mobile screens can feel cramped. Traders may find it more difficult to analyze multiple data points or perform complex technical analyses on smaller devices.

3. Connectivity Issues

Mobile trading relies heavily on a stable internet connection. In regions where connectivity is unreliable, traders may miss opportunities or face delays in executing orders. This dependency on network stability can be a significant drawback, especially during periods of high market volatility.

Tips for Successful Mobile Forex Trading

1. Choose the Right Trading App

Selecting a reliable trading app is crucial to ensuring a seamless trading experience. Look for apps that are user-rated, have good reviews, offer strong security features, and provide excellent customer support.

2. Stay Informed

Staying updated with market news, trends, and currency fluctuations is critical for any trader. Use your mobile device to access finance news apps, podcasts, or social media platforms that consolidate market information. Knowledge and timing, combined with mobile convenience, can significantly increase your trading success.

3. Practice Risk Management

Implementing robust risk management strategies is essential for successful trading. Use stop-loss orders, set realistic profit targets, and never risk more than you can afford to lose. Mobile platforms allow you to quickly adjust your trades as needed, but having a plan is crucial.

4. Use Demo Accounts

Many mobile trading platforms offer the option to trade with a demo account. This allows traders to familiarize themselves with the app and test strategies without risking real money. Utilize this feature to build confidence and refine your approach before committing significant capital.

The Future of Mobile Forex Trading

As mobile technology continues to evolve, the future of mobile forex trading looks promising. We can expect further enhancements in app functionality, increased security measures, and even greater accessibility to more traders worldwide. Innovations such as artificial intelligence and machine learning could also play significant roles in the development of automated trading tools, providing users with powerful resources to optimize their trading results.

Conclusion

Mobile forex trading has revolutionized how traders engage with the financial markets, offering unprecedented convenience and opportunities. Despite existing challenges, the benefits clearly outweigh them for many individuals. As technology advances, we anticipate an even more sophisticated mobile trading landscape, allowing traders to capitalize on opportunities anytime, anywhere. Whether you are a seasoned trader or just starting, leveraging mobile forex trading can provide immense advantages in your trading journey.